Content marketing offers a powerful avenue for businesses to connect with their target audience, build brand loyalty, and ultimately drive sales. However, measuring the return on investment (ROI) of content marketing can be challenging, leading some to question its effectiveness. This article delves into the intricacies of calculating content marketing ROI, providing you with the knowledge and tools necessary to demonstrate its value and optimize your content strategy for maximum impact. Understanding the ROI of content marketing is crucial for securing buy-in from stakeholders and justifying continued investment in this essential marketing discipline. By mastering the concepts presented here, you can transform your content marketing from a cost center into a demonstrably profitable engine for growth.

This comprehensive guide will explore the key metrics used to measure content marketing ROI, including website traffic, lead generation, sales conversions, and customer lifetime value. We will also discuss the various factors that can influence content marketing ROI, such as content quality, distribution channels, and target audience engagement. By understanding these factors, you can develop a data-driven content marketing strategy that delivers measurable results and contributes significantly to your bottom line. Finally, we will equip you with practical strategies for optimizing your content marketing efforts to maximize your ROI and achieve your business objectives. From keyword research and content optimization to social media promotion and email marketing, we will cover the essential tactics needed to boost your content marketing success.

Key Metrics to Measure ROI

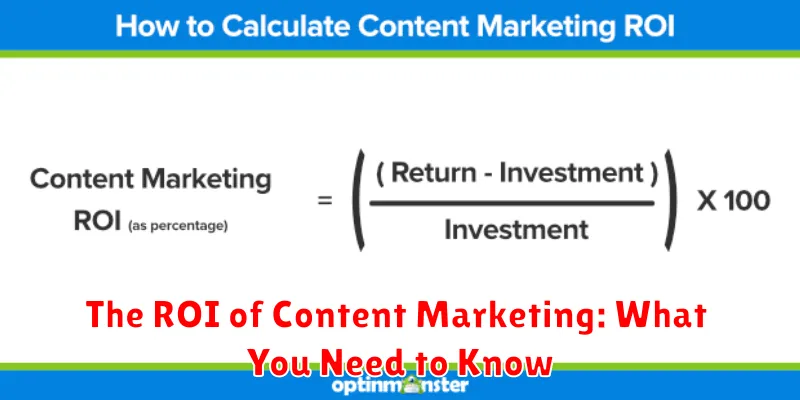

Return on Investment (ROI) is a crucial performance measure used to evaluate the efficiency or profitability of an investment. Calculating ROI involves comparing the gain from an investment relative to its cost. A high ROI indicates that the investment’s gains compare favorably to its cost, while a low or negative ROI suggests the opposite. Accurately measuring ROI is essential for informed decision-making across various business functions, from marketing campaigns to capital expenditures.

Several key metrics contribute to a comprehensive ROI calculation. Net profit, representing the total revenue minus total expenses, is a primary component. The cost of investment, encompassing all expenses related to the investment, is another crucial factor. The timeframe for the ROI calculation also plays a significant role, as it allows for a consistent comparison of investment performance over specific periods. Analyzing these metrics in concert provides a holistic view of an investment’s effectiveness.

Beyond the core calculation, other important metrics can provide further insights into ROI. These might include metrics like customer lifetime value (CLTV), which estimates the total revenue a business expects from a single customer, and customer acquisition cost (CAC), the cost associated with acquiring a new customer. Analyzing these metrics alongside traditional ROI calculations offers a deeper understanding of profitability, especially in customer-centric business models. By carefully considering these factors, businesses can make data-driven decisions and optimize their investments for maximum return.

ROI Benchmarks by Industry

Understanding Return on Investment (ROI) benchmarks is crucial for evaluating the effectiveness of your marketing efforts and overall business performance. ROI is a key performance indicator (KPI) that measures the profitability of an investment relative to its cost. Industry benchmarks provide valuable context, allowing you to compare your ROI to the average performance of similar businesses in your sector. Keep in mind that these benchmarks can vary significantly based on factors like company size, market conditions, and specific strategies employed.

While providing specific numbers for every industry is impractical due to constant fluctuations, some general ranges can offer a starting point. For example, software as a service (SaaS) businesses often aim for a customer lifetime value (CLTV) to customer acquisition cost (CAC) ratio of 3:1 or higher. E-commerce businesses may focus on a return on ad spend (ROAS) between 4:1 and 6:1. Industries with longer sales cycles, like manufacturing or enterprise software, might accept lower initial ROI figures while anticipating higher long-term returns.

It’s important to research benchmarks specific to your niche. Consulting industry reports, trade associations, and financial analysts can provide more granular data. Remember that using ROI benchmarks is not about blindly chasing numbers, but about gaining valuable insights into your performance and identifying areas for improvement. By regularly tracking and analyzing your ROI in comparison to industry standards, you can make more informed decisions and optimize your strategies for maximum profitability.